Why Glossier’s Valuation Reset Is a Wake-Up Call for Founders

For years, the "Unicorn" (a startup valued at over $1 billion) has been the ultimate status symbol in Silicon Valley. Founders chased it, VCs hunted it, and the media celebrated it. Glossier, the millennial pink beauty giant, was the poster child of this era after reaching a staggering $1.8 billion valuation in 2021.

But the party is over.

Glossier is now raising capital at a valuation "south of a billion dollars." It has faced layoffs, a pivot away from its Direct-to-Consumer (DTC) roots, and a harsh reality check.

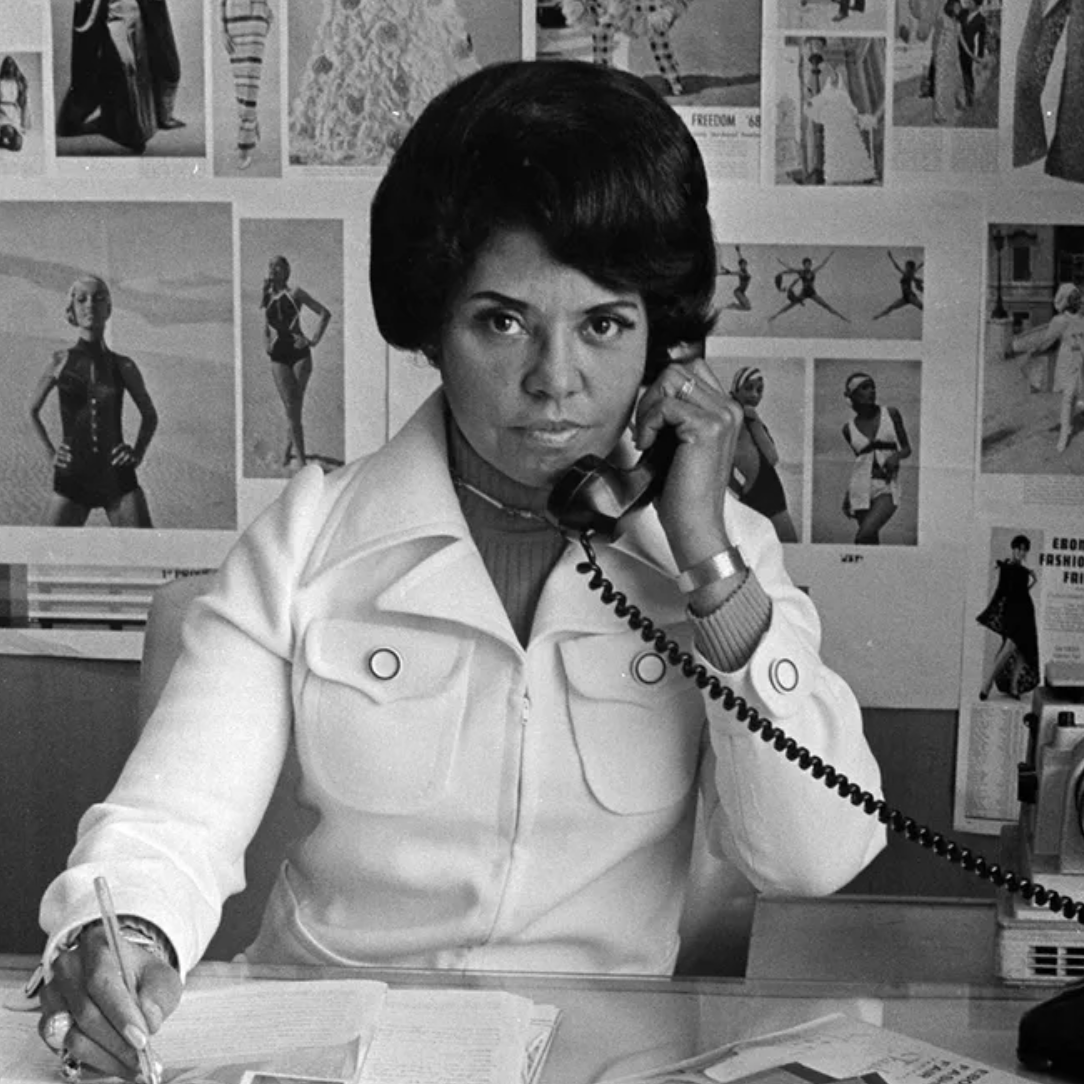

What happened? According to a brilliant new analysis by Sindhya Valloppillil, Founder & CEO of Skin Dossier and a former beauty industry executive, Glossier fell into a specific, seductive trap. They convinced themselves, and their investors, that they were a technology company instead of a beauty brand.

This isn't just a story about one company. It is a masterclass in Capital Strategy. Based on Sindhya’s deep dive, here is the playbook on why the "Unicorn" era of hype is ending and why the future belongs to the "Camel."

Click here to check out the original article by Sindhya.

Lesson 1: Beauty Brands Are Not Tech Companies

Glossier’s sky-high valuation was based on a myth. Like WeWork, they used the language of tech. By referring to themselves as a "technology company," they secured tech-level valuations from top-tier VCs like Sequoia and Thrive.

But as Sindhya points out, "Beauty brands aren’t really tech companies."

The Tech Expectation: Tech investors expect software margins, infinite scalability, and platform lock-in.

The Beauty Reality: Beauty involves physical inventory, shipping logistics, and a natural ceiling for DTC scale.

The Strategic Takeaway: Don't confuse your category to juice your valuation. When you take money from tech VCs who expect software growth rates, you set yourself up for failure. A beauty brand has different economics than a SaaS platform. Ignoring this leads to a "growth at all costs" mentality that is unsustainable for consumer goods.

Lesson 2: The High Floor Trap

Raising massive amounts of venture capital feels like a win, but it creates a dangerous mathematical problem. Sindhya calls this the "Floor."

"The more money raised, the higher the 'floor' is for a successful exit. If you raise $100M from investors, you need to exit for $100M just to pay back the investors."

By raising $266M, Glossier created a scenario where a "down round" (raising money at a lower valuation than before) effectively wipes out the equity value for many shareholders. The alignment between the founder, the employees, and the investors breaks.

The Strategic Takeaway: Capital is not a trophy. It is a liability. Every dollar you raise raises the bar for your exit. Raising less money allows you to have a life-changing exit at a lower number. Raising too much forces you to "go big or go home." Often, you end up going home with nothing.

Lesson 3: Hype is Not a Moat But Science Is

While Glossier struggled to maintain its "tech" valuation without proprietary technology, other brands are winning by actually building it.

Sindhya points to K18 and Oddity Tech as the new blueprint.

K18 didn't just have cool marketing. They had a patented peptide that repaired hair at a molecular level. They were acquired by Unilever for ~$700M because they had defensible IP.

Oddity Tech (Il Makiage) built a full-stack innovation platform with AI shade matching and hyperspectral imaging. They are profitable, growing, and publicly traded because their tech is real.

The Strategic Takeaway: "Vibes" are not a moat. In a crowded market, true value comes from differentiation. Whether it’s proprietary biotech like K18 or profitable operational efficiency, you need a hard asset that competitors cannot copy with a cheaper Instagram ad.

The Rise of the Camel

The era of the "Unicorn Mirage," or companies fueled by cheap capital and hype, is fading. Sindhya argues that we need to stop idolizing growth-at-a-loss and start canonizing a new animal: The Camel.

Camels are resilient. They can survive droughts or recessions. They prioritize hydration (profitability) over speed. They are built to cross the desert rather than just run a sprint.

"Let’s give credit to the camels that can weather droughts and recessions—not the unicorn mirages that raised too much venture capital too fast at inflated valuations."

For founders in 2025, the goal isn't to be a unicorn. It is to be profitable, sustainable, and real.