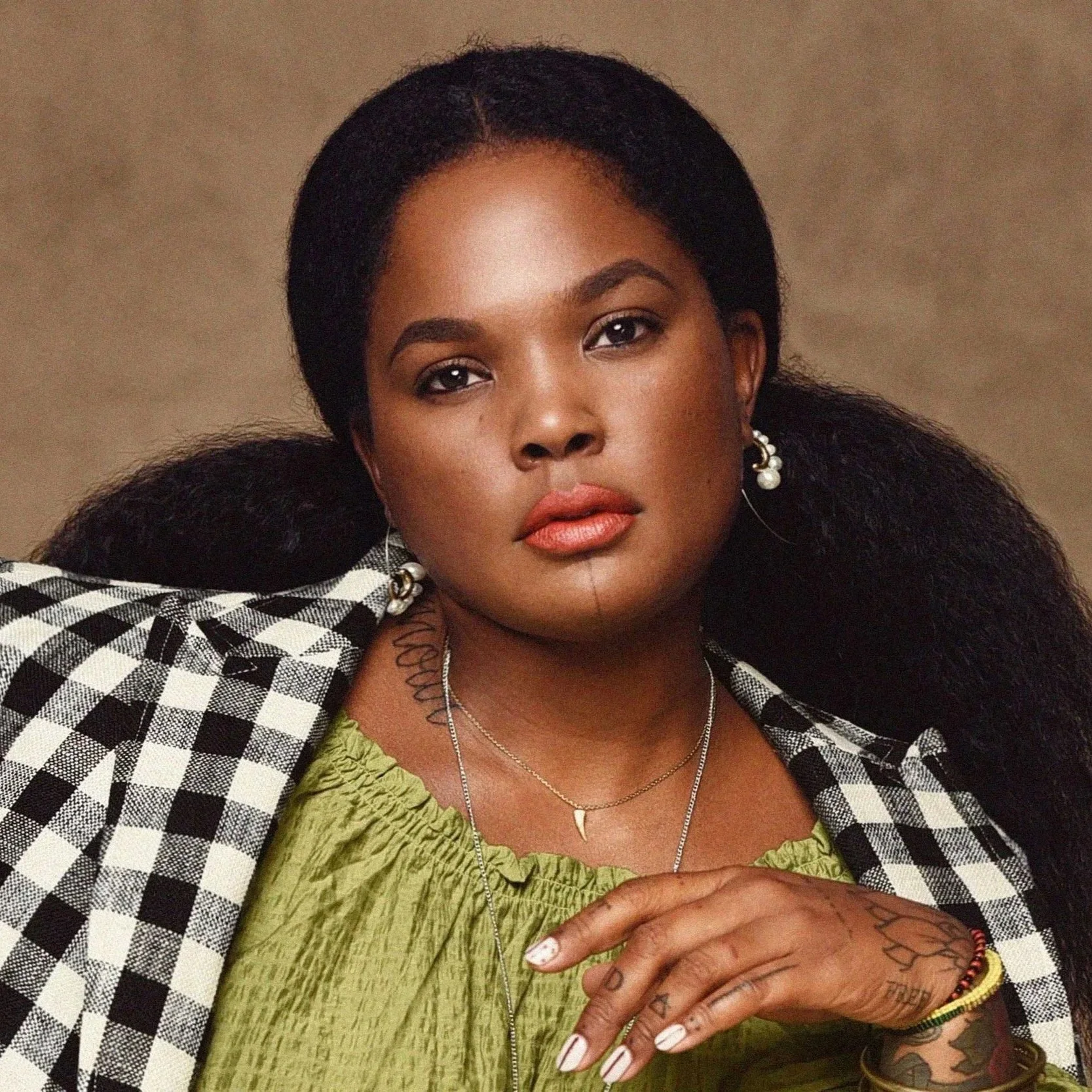

The $380 Million Dream: How Bea Dixon Turned Ancestral Wisdom into Generational Wealth

The Anti-Algorithm Origin Story

In 2025, the startup playbook is predictable. You find a "white space" in the market. You run focus groups. You A/B test your landing page. You let the algorithm tell you what to build.

Bea Dixon did none of that. She didn't have data. She had an infection.

For months, Dixon suffered from bacterial vaginosis. Nothing worked. The doctors failed her. The drugstore aisle failed her. Then, one night, she had a dream. Her grandmother, an ancestor she had never met, appeared and gave her a specific list of ingredients: lavender, rose, apple cider vinegar.

Dixon woke up, went to Whole Foods, and mixed the formula in her kitchen. It worked.

This is the first lesson of the Bea Dixon playbook: Intuition is the only proprietary data.

If she had looked at the market reports, they would have told her that the "feminine hygiene" aisle was an impenetrable fortress owned by multi-billion dollar giants like Procter & Gamble. The data would have said "Do not enter." Her intuition said "Disrupt."

Polarity is Profit (The Target Effect)

Most founders are terrified of offending anyone. They dilute their message until it is a beige slurry of corporate-speak.

Bea Dixon proved that in a noisy world, Polarity is Profit.

In 2020, Dixon starred in a Target commercial. She looked into the camera and said: "The reason why it's so important for Honey Pot to do well is so the next Black girl that comes up with a great idea, she can have a better opportunity."

The reaction was explosive. Internet trolls review-bombed her products, calling the ad "reverse racist" and demanding a boycott.

A traditional CEO might have issued an apology. Dixon stayed silent and let the community speak for her.

The result? Her supporters rallied. Sales spiked 50% overnight. Her products sold out in Target locations across the country. By clearly stating who she was fighting for, she didn't just get customers; she got an army.

The Unapologetic Exit

There is a stigma in the founder world about "selling." We romanticize the struggle. We tell founders to hold onto 100% of their equity until they die, often equating an acquisition with "selling out."

In January 2024, Bea Dixon shattered that narrative.

She sold a majority stake in The Honey Pot Company to Compass Diversified for $380 million.

But here is the "Unfiltered" part: She didn't walk away. She structured the deal so she remains the CEO and Chief Innovation Officer. She didn't sell out; she bought in.

Redefining the "Exit"

This deal represents a new maturity in the minority founder playbook.

For too long, the goal has been to own a small pie entirely. Dixon realized that the real goal is Generational Wealth and Global Scale.

"I want to see this company become a global brand so women everywhere can have access to our healthy products," she said.

To do that, she needed capital. She needed infrastructure. She needed a partner who could put The Honey Pot in every bathroom from London to Lagos. By selling a stake, she secured the resources to win the war, not just the battle.

The Lesson for 2026

Bea Dixon proves that you can be spiritual and strategic at the same time. You can take business advice from your ancestors and deal terms from private equity.

She teaches us that the ultimate flex isn't doing it all by yourself. The ultimate flex is building something so valuable that the market has to pay you $380 million to keep you in the driver's seat.