Beyond Investors: How these Female Founders Funded Their Dreams Differently

For many aspiring founders, it’s easy to assume that fundraising is the only ticket to startup success. Securing a big check early on can feel like the ultimate validation—and for beginners, it might even seem like a non-negotiable. But while raising capital is one path, it’s far from the only one. In fact, some of the most innovative and resilient businesses are built on creativity, resourcefulness, and a scrappy, roll-up-your-sleeves attitude.

The founders featured here—all part of the Dreamers & Doers community—prove that you don’t need deep pockets to make a deep impact. They share the unconventional strategies and practical steps they used to launch—and grow—without investor dollars upfront, offering a roadmap for anyone determined to bring their vision to life on their own terms.

Nicole Leon

Founder of L. Leon Virtual Assistance, a boutique virtual support business for stretched-thin leaders who are ready to delegate with intention.

Credit: Samantha Fandino

I funded my entrepreneurial journey the hard way, through sheer hustle. In the early days of my lash business, I worked a 9–5, went to school in the evenings, and then did lashes late nights and weekends to stack enough income to eventually leave my job and be fully self-employed. When it came time to launch L. Leon Virtual Assistance, I reinvested the money from that first business into building the second, covering software, branding, and systems. No grants, loans, or scholarships; just sweat equity, discipline, and the belief that ownership was worth the sacrifice.

Don’t underestimate the power of small, consistent reinvestments. Even if you can’t invest big upfront, those incremental steps compound quickly and allow you to scale without debt. Bootstrapping taught me resilience and creativity. It also gave me confidence to expand into multiple ventures while staying fully self-funded.

Chef LaToya Larkin

Founder & Tamale Disruptor of Black Girl Tamales, a gourmet fusion food brand redefining tradition with bold, innovative flavors.

Credit: Enobong Houston ""EJaye""

A combination of personal sacrifice, disciplined credit building, and support from family allowed me to move forward without waiting on outside investors. I got resourceful by leaning on what I already had and making it work for me. I cashed out my teacher retirement to create my initial seed capital and invested it straight into building the business. At the same time, I focused on getting my credit score up so I could qualify for additional funding when needed.

One piece of advice I wish someone had given me earlier is to build business credit before you need it. I focused so much on fixing my personal credit and using my own resources that I didn’t realize how much easier it would have been to separate my business finances early on and leverage business credit lines. Having that foundation in place would have protected my personal assets and given me more flexibility to scale without as much personal sacrifice.

Becka Dente

Founder & CEO of Purple Insights, strategic operations partners specializing in revenue operations using a holistic approach that aligns your sales, marketing, and customer success functions for maximum growth impact.

Credit: 360 Productions

My business started as a side hustle. I worked on it in my free time, slowly building a steady stream of revenue. At first, my set-up was scrappy. I used a free Salesforce tool for my CRM, had a free Gmail account, and created a LinkedIn Company page for free. I didn't take any money out of the business, and instead slowly invested in tools as I could afford them.

You don't need a lot to get your business off the ground. Start small and invest where and when it's appropriate.

Linda Du

Co-Founder & CEO of Moola Money, an AI-powered financial advisor helping millennials in the UK gain clarity and confidence over their finances by combining psychographic insights, a holistic financial health check, and personalized recommendations.

Credit: Alina Rudya

I actually started Moola Money as a way to fund my previous investment company. Friends and contacts began asking me for investment advice, and I charged for helping them with financial modeling, applying the same frameworks I’d used as a management consultant to their personal finances. Ultimately, I decided to automate the model after a few projects, turning what was originally a side income stream into the foundation for Moola Money.

Throughout this process, I learned that you don’t need to charge for everything in the early days. During our Alpha program, for example, we prioritized feedback over revenue, which gave us invaluable insights to shape the product roadmap.

Kelly Hubbell

Founder & CEO of Sage Haus, creating a new category in the caregiving space by recruiting and training holistic house managers who go beyond traditional single-track roles like nannies or housekeepers to provide comprehensive household support that helps busy families reclaim their time.

Credit: Lion & Oak Photography

I bootstrapped Sage Haus during my maternity leave, leveraging the most valuable resource I had: time. While my baby napped, I invested my energy into building the business foundation, using personal savings strategically to launch our first website and develop digital products. This approach forced me to be incredibly resourceful and focus intensely on finding product-market fit quickly, since I couldn't rely on external funding to sustain operations while figuring things out.

Take a chance on yourself! Embrace the urgency that comes with bootstrapping. Having a fire inside to achieve profitability without outside funds can be your greatest competitive advantage.

Amanda Hofman

Chief Swag Officer of Go To Market, the anti-boring branded merch and swag experts changing the way the world handles swag, designing sustainable branded merchandise shops that reflect our clients’ brand values.

Credit: Julia Guignard

When I started my first company, I kept my full-time job for the first year so I could build the business with a safety net: steady income, health benefits, and room to experiment. That set-up gave me the freedom to make smart, creative decisions without operating from panic. For early-stage entrepreneurs, that kind of stability is a game-changer.

In a Shark Tank world, it’s easy to think you have to start big. But starting small—bootstrapping, side-hustling, or keeping your day job—can be the smartest, safest move, especially if you’re new to entrepreneurship and still figuring out if it’s the right path.

Victoria Bevilacqua

Founder & CEO of Saltwater Agency, a boutique creative studio specializing in social media, branding, and web design, helping entrepreneurs and lifestyle brands grow with strategy-driven content, bold storytelling, and design that actually converts.

Credit: Liz Salzman

We’ve focused on building a sustainable business by prioritizing what actually matters: delivering exceptional value for our clients and creating a positive, supportive work environment for our team. We’ve intentionally skipped the expensive overhead—no fancy offices, no unnecessary extras—and reinvested directly into strategy, coaching, and growth opportunities. This lean, client-first approach has allowed us to grow steadily while keeping full control of our vision.

I wish someone had told me earlier that staying lean is a strength, not a weakness. You don’t need to look big to build something impactful. You just need to invest wisely in what truly moves the needle.

Catalina Parker

Co-Founder & CEO of Relatable Nonprofit, helping nonprofit leaders launch and grow consulting businesses.

Credit: Maxson Media

My business partner and I each invested $1,500 of our own money to get our business off the ground, and we’ve bootstrapped it ever since. Sure, outside capital could have helped us grow faster, but we’d rather maintain full control. Funding ourselves made us scrappy and forced us to focus on making money instead of spending it.

Be conservative with your money. Don’t just focus on revenue—know your profit. And always keep a reserve for emergencies.

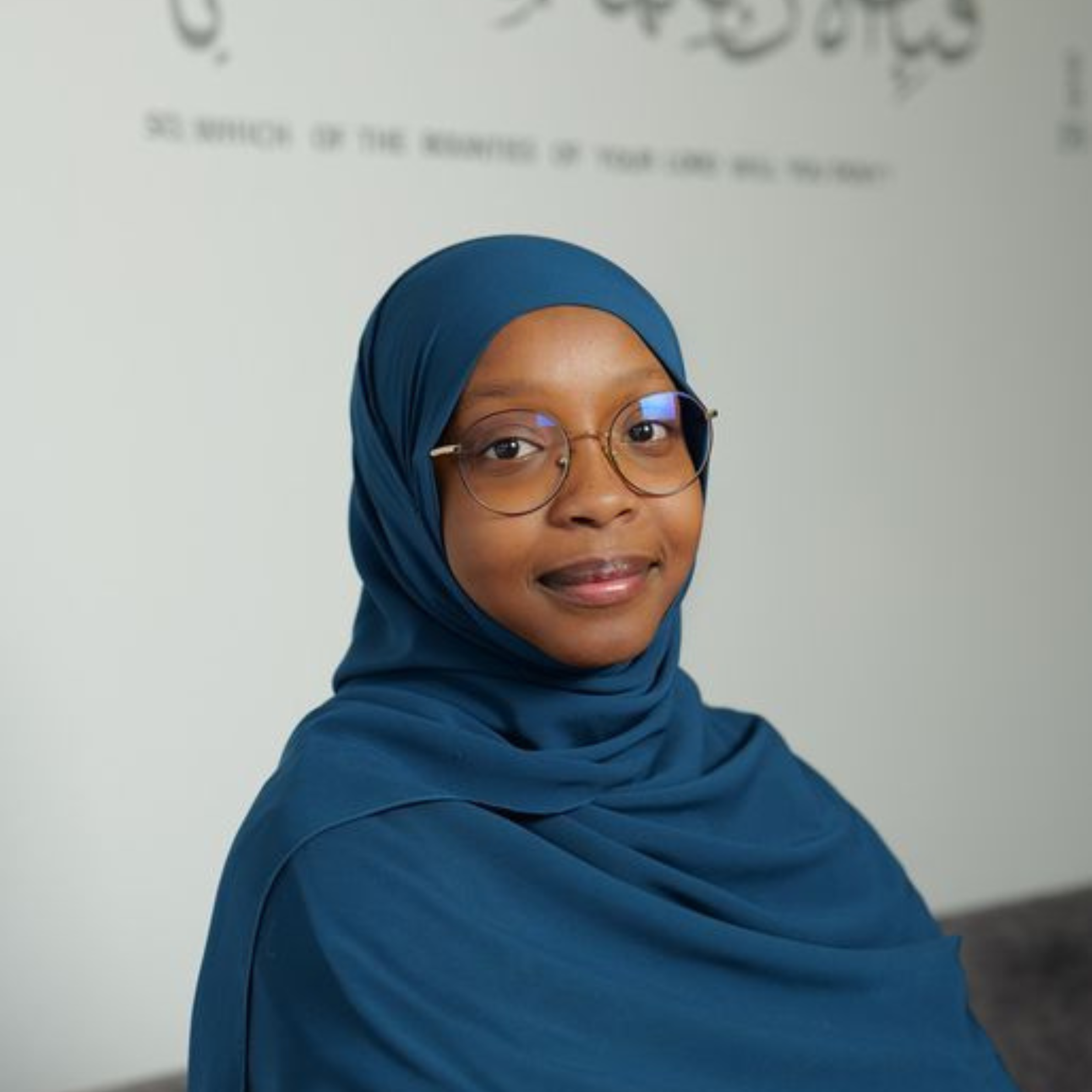

Eman Abdur-Rahman

Founder of Your Virtual Keeper, helping mission-driven service providers simplify their financial management, providing clarity through tailored workflows, comprehensive reporting, and a dedicated team that takes accounting off their plate so they can focus on their mission and growth.

Credit: Kathleen

Before launching my firm, I bootstrapped in creative ways.I sold bulk gummies, homemade teas, and desserts at local fairs—where I often sold out within hours. My husband and I also flipped furniture, finding pieces at estate sales for a dollar and reselling them through a storage unit set-up. These side hustles generated the seed money that allowed me to start Your Virtual Keeper without loans or outside investment. Through this experience, I learned that resourcefulness, persistence, and community-driven hustle can build a strong foundation for a business.

You don’t need big funding to get started. To keep moving forward, you need creativity, discipline, and the right community around you. I also recommend using as many free resources as possible to help you learn and structure your first phase of business.

Patty Williams-Downs

CEO & Founder of BreakingBounds, a consulting firm delivering leadership solutions for business transformation, envisioning a world where socially impactful companies have the resources and tools to realize their vision through strategic planning, leadership development, executive coaching, and our newest offering: a business education experience designed specifically for the nonprofit sector.

Credit: Stevie D. Photography

There’s a mantra we use both internally and with our clients: No money, no mission. To launch our services, we didn’t need seed funding; we needed early adopters who believed in our work and invested in it to advance their own missions. A clear business model is non-negotiable, so we built one that was scalable and aligned with our vision to support people doing incredible work to sustain and uplift our human existence.

One piece of advice I wish someone had given me is to find a trusted business consultant—someone who’s not just a friend or listening ear, but who can also help you examine your business model, profit margins, and goals. The right advisor can inform strategic pivots or overhauls that are essential to long-term success.

Sydney de Arenas

Founder & CEO of The Hive, dynamic business concierge helping entrepreneurs grow, scale, and thrive.

Source: Decontrol Studops

I began with one client I could manage on my own, then added another before bringing in a part-time college student for support. Each new client allowed me to expand gradually, adding additional part-time students as needed. I relied on my network to secure clients and grew steadily without outside capital. Because I quit my job to start this business, I had to make it work, and as a result, I ultimately built a stronger, more sustainable company.

Later, I fundraised for another business, and I wish I had known to treat fundraising capital like bootstrapping. Large sums disappear quickly, so spend as if no other investment is coming and focus only on what truly drives the business forward.

Mari Milenkovic

Founder & CEO of With Mari, a high-touch marketing consultancy and retreat experience designed to help female founders gain clarity, confidence, and sustainable growth.

Source: Jessica Koehler

I decided early on that I didn’t want to rely on debt or outside investment to grow. Instead, I bootstrapped by offering high-margin services, keeping expenses lean with low-cost tools, trading my expertise for key services, and reinvesting profits back into the business. My first revenue goal wasn’t about personal income; it was about building enough savings to cover several months of operating expenses. Having that cushion lowered my risk, kept me out of a scarcity mindset, and gave me the confidence to pursue growth opportunities.

Early on, I wish I’d known how dangerous it is to operate from a scarcity mindset. Having a plan to build financial stability from the start inspires confidence and better decision-making.

Deirdre Davi

Founder & CEO of Elivate, making healthspan improvement accessible and affordable by developing the first national preventative nurse provider network to deliver cutting-edge healthspan solutions directly to consumers at home.

Source: Deirdre Davi

I've done my best to continue stacking cash inflow. I started by leveraging income from my consulting firm. When I had to get scrappy to keep the business going at a critical inflection point, I leaned on some unusual resources: parent PLUS loans available because of my newly-enrolled college student and a homeowner's insurance reimbursement that I wouldn't have pursued otherwise.

While I’m not sure I’d recommend these exact pathways, I've chosen to be proud of my relentless determination. Ultimately, I decided my vision was too big to not raise money. I’ve since stepped into my “don’t miss out on investing in me” identity and nailed my IIP (ideal investor profile) so I don't wear myself down with feedback from investor prospects that won't play.

Yewande Faloyin

CEO & Founder of OTITỌ Leadership & People Development, partnering with scaleups and hedge funds to build strategic leaders, high-performing teams, and a culture that drives measurable results for our clients and their investors.

Credit: Yewande Faloyin

From the start, I treated my business finances like I would my personal ones. I didn’t pay for anything until I truly had to, and I built an emergency fund early so I could sleep better at night. Tracking everything I spent gave me clarity and meant I could pay myself steadily, like a salary, instead of being at the mercy of cash flow ups and downs.

I was fortunate early on to invest in a business coach and adviser who gave me great financial advice, especially around funding. Their guidance was to get money up front and think creatively about funding sources, because clients can be just as powerful as investors in financing your next phase. The key is to prioritize profitable funding—not just funding that gets you to the next crisis.

Gabriela Fiorentino

Founder of Nest Earth, a growing community where parents can access trusted experts, resources, and real-life solutions to raise healthier kids and protect the planet.

Credit: Gabriela Fiorentino

I bootstrapped Nest Earth with income from consulting in sustainable design and small, fee-based workshops. To make this happen, I repurposed free or low-cost digital tools and leveraged barter/partnerships with aligned experts to build content and community without steep upfront costs. I also leaned on membership and donation support to cover ongoing operational costs. Working lean kept us true to our values and allowed flexibility while we discovered what our community needed most.

Don’t wait until everything is perfect. Instead, start with what you can do right now with what you already have. Small revenue streams add up and give you breathing room to stay mission-aligned without sacrificing ownership.

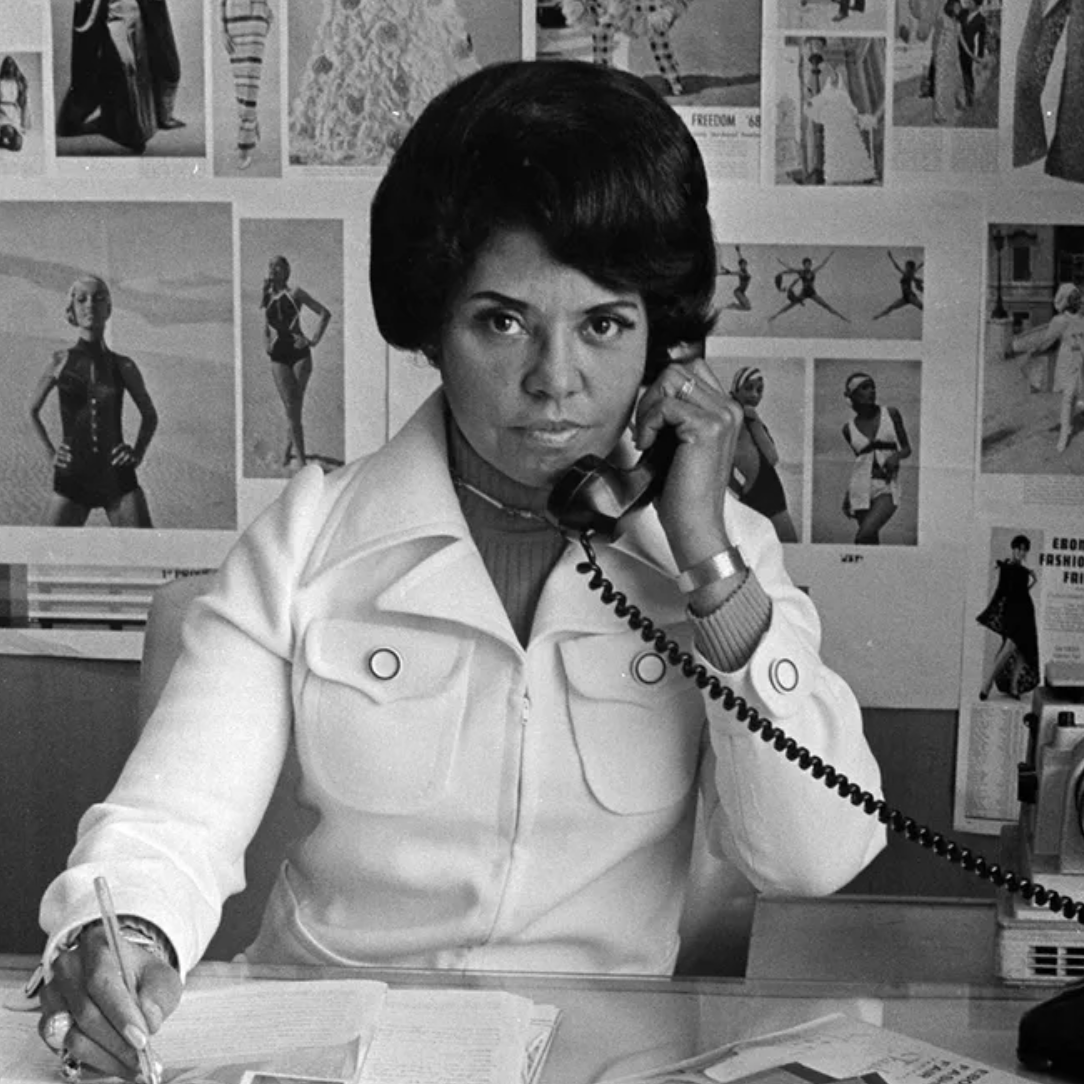

CK Harmon

CEO & Founder of Venus Walks, creating fine jewelry smoking accessories for the modern and elegant cannabis connoisseur.

Credit: Alyssa Rubio

In classic startup fashion, I learned about lawyers the hard way and sold my car to cover the bills. Ridding myself of excess expenses, I packed up my iPad and set sail for a small town in the south of France. In the three months I was there, I saved a couple thousand dollars and officially marked the beginning of pursuing Venus Walks full-time. Today, I’m bootstrapping, picking up side work as a tennis coach to increase our cash reserve.

Advice from Rebecca Minkoff shifted my perspective. She said it’s typical to frame an abundance of investors as the final accomplishment—but real freedom comes from successfully bootstrapping to profitability and having more control in the boardroom as a result.

Brooke MacLean

CEO of Marketwake, an award-winning performance marketing and creative services agency blending data-driven creativity with brand strategy.

Credit: @ltphotoandfilm

The vision for Marketwake was always a self-sufficient one. This meant making sacrifices: asking for payments upfront; structuring contracts creatively; and stretching every dollar as far as we could, from hiring and resources to going out of scope to keep our most valuable clients. It wasn’t always glamorous, but I can happily and gratefully say that to this day, Marketwake remains a 100% independently, women-owned company.

I wish someone had told me that being “self-sufficient” doesn’t mean doing it all alone. I resisted taking on any kind of financing because I didn’t want to be tied down, but I could have benefited from setting up a line of credit or building a strong relationship with my banker earlier. Having access to capital when you actually need it is a game-changer, and it doesn’t mean you’ve sold your independence.

Elle Wilson

Founder & CEO of Met Through Friends, the home of the Plus-One Party: IRL dating events where everyone brings a great single friend of the opposite sex for someone else to meet.

Credit: LinkedIn Headshots

A lot of aspiring founders I speak to assume they need to do something dramatic—like quit their 9-5 completely or save over six figures—to get things off the ground. I was able to fund my business in a way that was much more comfortable and a lot less jarring: working half-time for a previous employer with whom I already had a great relationship. Having a steady, part-time income while building my business on the side allowed me the creative freedom and brain space to experiment with Met Through Friends without putting pressure on it to generate full-time income right away.

A lot of messaging in the world of startups and small businesses is focused on securing VC money. While I agree that it’s a great option for many, I actually don’t think it’s the end-all, be-all. By seeking baseline income from part-time work, I was able to maintain complete creative control of my company, keep things lean, and prioritize quality learnings over the need to scale. Being open to unconventional income arrangements allowed me to build my business on my terms.